The digital media landscape faces another blow as Vice Media recently announced the closure of its website and staff reductions. The once-mighty Vice Media, a millennial digital media pioneer, continues to face uncertainties following its 2023 bankruptcy.

Vice Media: The End of An Era?

Vice Media began as a punk magazine in Montreal in 1994, rapidly transforming into a global media giant during the 2000s.

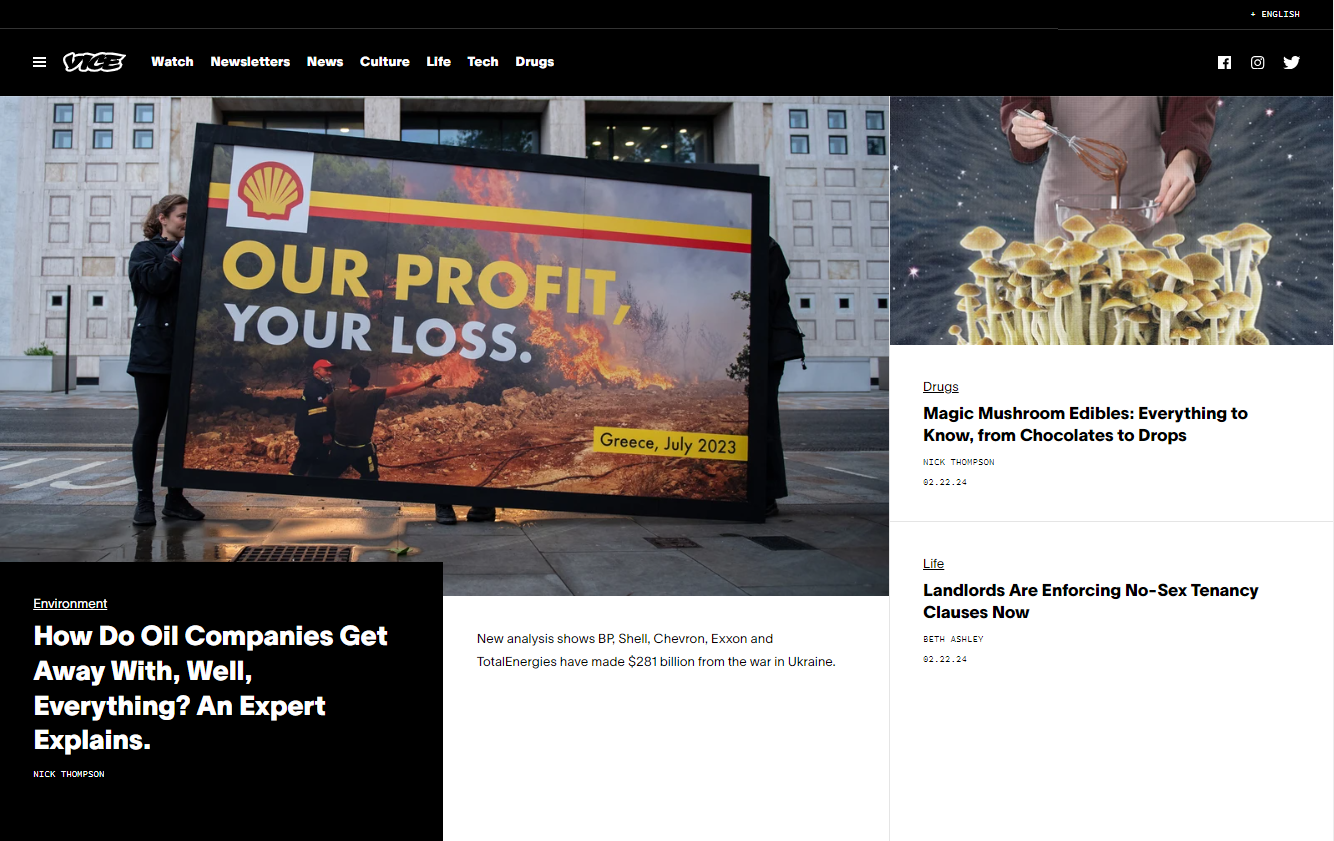

Its brand became synonymous with gonzo journalism, which covered edgy and provocative reporting of drugs, sex, and war zones.

In May 2023, Vice Media filed for bankruptcy, marking a significant turning point for the company. Despite being acquired by New York-based Fortress Investment Group for $350 million, Vice was forced to implement drastic cost-cutting measures. This included multiple rounds of layoffs and the cancellation of its flagship program, Vice News Tonight.

Adding to the blow, the company announced a major shift in its strategy. CEO Bruce Dixon revealed in a widely circulated memo that the company will cease publishing original content on its flagship website, Vice.com.

Instead, the business will transition to a “studio model,” focusing on partnerships with established media companies to distribute their content. This move comes amidst ongoing financial challenges faced by the company.

3 Plausible Factors Contributing to Vice Media’s Challenges

-

Unsustainable Business Model

The digital media company once held a valuation of $5.7 billion at its peak in 2017, but its valuation decreased over time. In recent years, the company has faced financial difficulties and raised questions about its future, including missed revenue targets and losses.

Critics argue the company never established a solid, profitable business model despite its initial success. They relied heavily on partnerships and investments but struggled to translate content into consistent revenue streams.

Moreover, the media landscape has become increasingly competitive, affecting Vice’s ability to stand out and attract advertisers.

As numerous traditional media entities pivot towards subscription models, they are diminishing their dependence on advertising and instead cultivating dedicated audiences. But Vice has lagged in this transition.

Additionally, the company is reportedly considering selling its Refinery29 publishing business as part of cost-cutting measures. The potential sale reflects the broader struggles digital media companies face and highlights the need to adapt and rethink strategically to navigate the ever-changing digital landscape.

Right now, Vice’s most viable options are either building an audience willing to pay for content or attracting a valued demographic that advertisers are eager to reach. However, both paths still need to be explored within the current media landscape.

-

Shifting Media & Consumer Landscape

While the company was initially successful in reaching a younger, digital-savvy audience, adapting to changing digital consumption patterns and preferences proved to be challenging.

In 2018, Facebook (now Meta) implemented algorithmic changes that significantly reduced the visibility of publishers’ content. This resulted in a sudden and substantial decline in traffic for all digital media brands.

Furthermore, the media industry experienced significant changes with the rise of a new form of digital content and changes in consumer behaviour.

The rise of streaming services disrupted traditional media, impacting the company’s core audience and advertising revenue. Vice was caught in a downward spiral as the digital advertising market experienced a downturn and new platforms like TikTok emerged.

Not only that, advertisers have lost interest, and Gen Z audiences have not clicked with its edgy content. Pedro Avery, co-founder of Bicycle, said: “Their ‘edgy’ style lost its novelty factor. Younger audiences gravitated towards more authentic content on platforms like YouTube and especially TikTok — alongside these platforms becoming homes for creators.”

-

Questionable Leadership & Inconsistent Strategies

The company often faced controversy about its workplace culture, misconduct allegations, and leadership inefficacy.

It was reported that certain business decisions the company’s executives made raised questions about its strategic direction and competence.

Examples include significant investments in websites that were promptly closed, and the company’s approach toward video content fluctuated without a long-term vision. The seemingly ill-conceived launch of a TV channel, misaligned with the preferences of the millennial demographic, further reflected this problem.

In a postmortem podcast, since removed, departing Vice staffers attributed these failures to inexperienced leadership and disastrously inconsistent strategies.

On top of that, Sirin Kale, a former Vice journalist, reported these recent developments might have been viewed with greater acceptance had the company’s leaders exhibited stronger ethical conduct. Namely, awarding large bonuses to senior executives in 2023, coinciding with Vice’s bankruptcy filing, generated significant criticism.

Image Source Craig BarrittGetty Images for VICE Media

This, in light of subsequent mass layoffs impacting even employees on maternity leave, many view this as a lack of respect and fairness towards the broader workforce.

Additionally, a company executive’s sale of a lavish personal property during the same period further aggravated public perception, raising questions about the company’s priorities and handling of its financial situation.

Beyond the Downfall of Vice Media

While the full extent of the consequences will play out over time, Vice Media’s downsizing signifies the ongoing challenges faced by the digital media industry. It impacts not just the company itself but also the entire industry’s ecosystem and its consumers.

The development, coupled with challenges posed by the COVID-19 pandemic and inflationary pressures, presented significant difficulties for the company.

Simon Childs, via Novara Media, had this to say about the whole situation: “If there’s anything positive to be dragged from the wreckage, it’s that there is now a chance for journalists to put their energies into something other than a company that is fatally undermined by a worthless business model devised by feckless, overpaid executives.”

What Lies Ahead: The Future of Digital News Brands

Despite the storm, Vice demonstrated greater resilience than some of its newer media competitors. In the past year, sites like The Messenger, BuzzFeed News, and Jezebel shut down, with media outlets implementing budget cuts and layoffs to reduce overhead.

Data gathered by The Myers Report on over 200 media sales organisations suggests a potential decline in the number of content creation providers and distribution platforms. This decline is likely due to consolidation, changing consumer habits, or other factors.

Besides that, media companies struggle with declining advertising revenue and the rise of subscription-based platforms, making it challenging to sustain multiple platforms simultaneously. The market is already crowded with various content providers, creating tougher competition and potentially hindering the long-term viability of newer platforms.

The future of content creation and distribution platforms remains to be determined. While The Myers Report’s data suggests a potential decline, it’s crucial to remember that the media landscape constantly evolves.

Platforms that embrace adaptation, innovation, and niche market opportunities might still find success. Mergers and acquisitions could also play a role, leading to consolidation within the industry.

Ultimately, the fate of these platforms will depend on their ability to navigate the challenges of a changing market, adapt to consumer preferences, and offer unique value propositions to their audiences. While some platforms may face significant difficulties, others hold the potential to thrive in this ever-evolving digital ecosystem.