Jollibee Foods, the Philippines’ leading fast-food chain, announced a significant move towards global dominance in the coffee market. For a total of $340 million, the company is acquiring a majority stake in Compose Coffee, a South Korean coffee chain. Jollibee Worldwide Pte, a subsidiary of Jollibee Foods, will hold the majority stake, 70%, valued at $238 million, while its affiliated Titan Fund will hold an additional 5%. The remaining 25% will be owned by private equity firm Elevation.

Brewing Success: Jollibee’s Strategic Move into the Coffee Market

According to Reuters, Compose Coffee has 2,470 franchised stores, which gives it a debt-free balance sheet, good cash returns and profit margins. The deal will increase its global store network to 10,000. This acquisition, Jollibee’s largest by number of stores, signifies their continued push into overseas markets. With this deal, the majority of Jollibee’s branches will soon be located outside the Philippines.

But the real prize? Access to South Korea, a nation practically running on coffee, ranks third globally in per capita consumption. With this acquisition, Jollibee instantly becomes a coffee powerhouse.

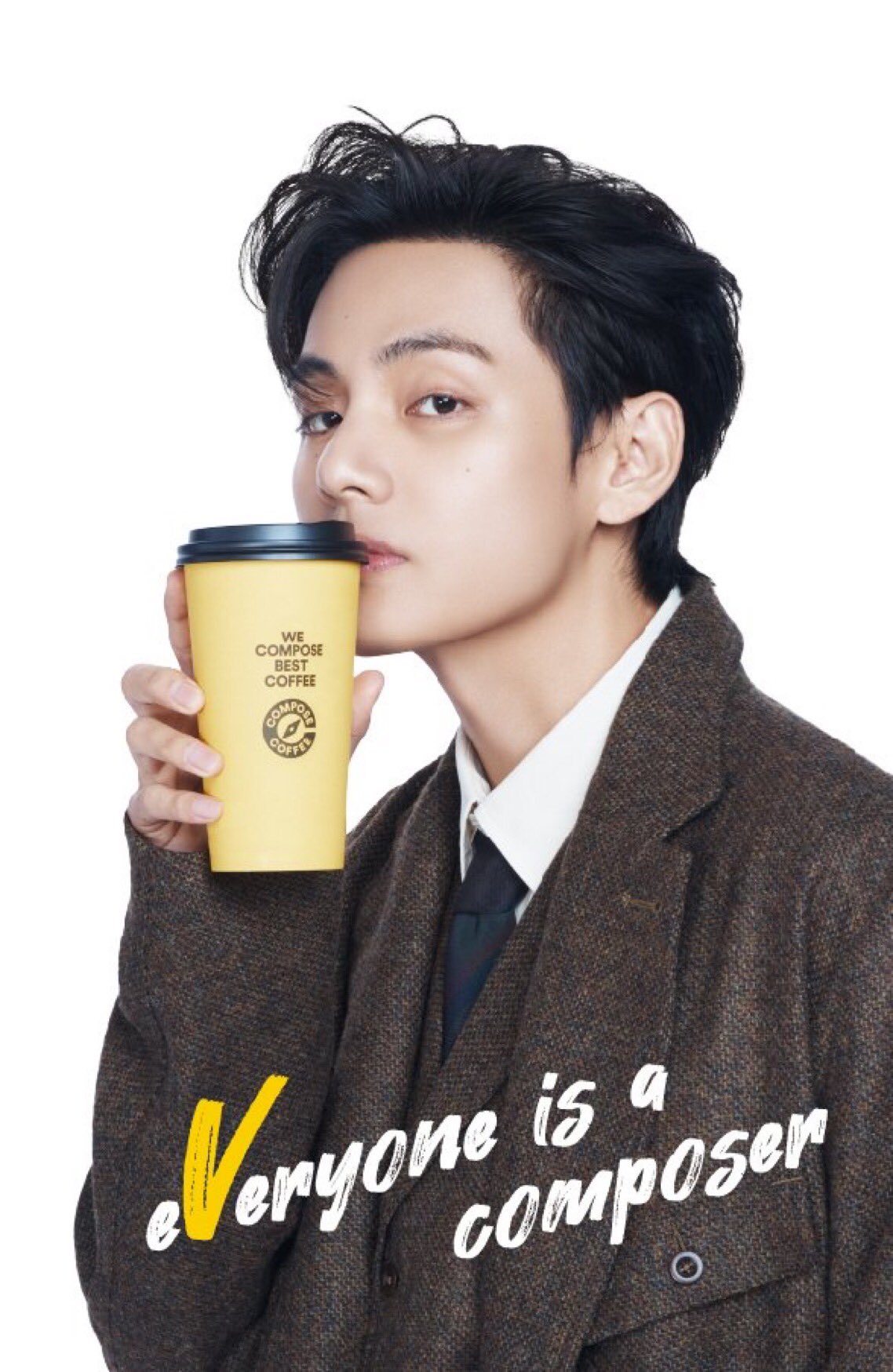

In addition, this deal positions Jollibee to become a significant player in this booming market, with freshly roasted opportunities brewing thanks to the coffee chain’s established popularity, further fuelled by its recent marketing coups, securing global superstar BTS’s V as its brand model.

Unlocking Potential: The Future of Jollibee

Jollibee, already a well-established global brand, aims to leverage its extensive international presence and operational expertise to drive Compose Coffee’s growth. By integrating Compose Coffee into its portfolio, the company can diversify its offerings and attract a broader customer base.

In a move similar to its 2019 strategic investment of $100 million to acquire Coffee Bean & Tea Leaf, a coffee chain experiencing financial difficulties at the time, the company sets its sights on further growth with the acquisition of Compose Coffee. This move strengthens the company’s presence in the competitive coffee market and expands its reach into the lucrative South Korean market.

Unlocking Potential: Compose Coffee’s Growth

The intense competition within South Korea’s domestic coffee market has driven budget-friendly coffee chains to seek growth opportunities abroad. Compose Coffee’s initial foray into the Singaporean market in 2023 exemplifies this trend.

Citing the potential saturation within the domestic coffee market, an industry source commented for Business Korea that the long-term growth trend may plateau. They emphasised the importance of monitoring Jollibee’s strategy for expanding Compose Coffee stores. Given Jollibee’s global presence, the source speculates that the company may prioritise international markets over further domestic expansion.

Under Jollibee’s leadership, we can anticipate a significant increase in Compose Coffee’s global footprint, with accelerated expansion plans, exploration of new markets, and introduction of innovative coffee products to meet evolving consumer preferences.

Conclusion

The strategic partnership between Jollibee and Compose Coffee sets the stage for an exciting future. This collaboration will create synergies that drive innovation and operational efficiency. Jollibee’s extensive supply chain network and marketing expertise will complement Compose Coffee’s strong brand identity and product offerings. This partnership will enable both brands to stay competitive in the dynamic coffee market, continually adapting to trends and consumer demands.